Cardiff CEO William Stern warns of a “Great Separation” as small business costs rise despite cooling inflation and Federal Reserve rate cuts.

The businesses that survive 2026 will not be the ones waiting for the Federal Reserve to save them. They will be the ones that accept the new math and protect their cash flow.” — William Stern, Founder and CEO of Cardiff,

SAN DIEGO, CA, UNITED STATES — Cardiff, a leading small business fintech, has released a comprehensive new report titled “The Private Recession.” The report, authored by Cardiff Founder and CEO William Stern, details a “Great Separation” in the American economy, where the cost of capital for the Fortune 500 is falling while the cost of survival for Main Street continues to rise.

In an open letter to clients and partners, Stern notes a dangerous divergence between market optics and economic reality. “There is a difference between the weather and the climate,” Stern writes. “The weather is what you see on CNBC: the daily up-and-down of the S&P 500. The climate is what you feel in the real economy: the cost to hire a welder, the price to insure a warehouse, and the speed at which a customer pays an invoice.”

The “3.5% Illusion” and the Main Street Reality

The report’s Executive Summary challenges the prevailing Wall Street narrative that a “Soft Landing” has been achieved. While the Federal Reserve has cut rates to the 3.5%–3.75% range, Cardiff’s proprietary data reveals a historic decoupling between the Financial Economy (Wall Street) and the Physical Economy (Main Street).

As public markets celebrate the “Fed Pause,” private operators are entering a “Private Recession.” Small business bankruptcy filings (Subchapter V) surged 11% in 2025, serving as a leading indicator that the “lag effect” of tighter capital is finally breaking the balance sheets of the bottom 50% of American businesses. This isn’t about pessimism; it is about preparedness.

The Rate Reality and “Shadow Taxes”

A core focus of the report is the “Prime Trap.” For a private business, Cardiff argues the Fed Funds Rate is largely irrelevant. The “Effective Cost of Capital” for SMEs has not dropped; it has risen. While the risk-free rate has compressed, private credit spreads have widened by 150+ basis points for non-investment grade borrowers. The average all-in coupon for a private equipment or working capital loan remains stuck at 9.5%–11.5%. Cardiff advises clients to ignore the “Dot Plot” and model for 9% money in 2026.

Further complicating the landscape is the “Shadow Tax.” While headline inflation is cooling to the 2.6% range, specific costs that impact small businesses continue to climb. Property CAT (Catastrophe) deductibles have pushed the effective cost of risk transfer up 22% YoY in key coastal markets. Additionally, the report indicates that the supply chain is bracing for peak tariff pass-through in Q2 2026, resulting in a 12-15% erosion in EBITDA purely due to non-interest fixed costs.

The Productivity Paradox

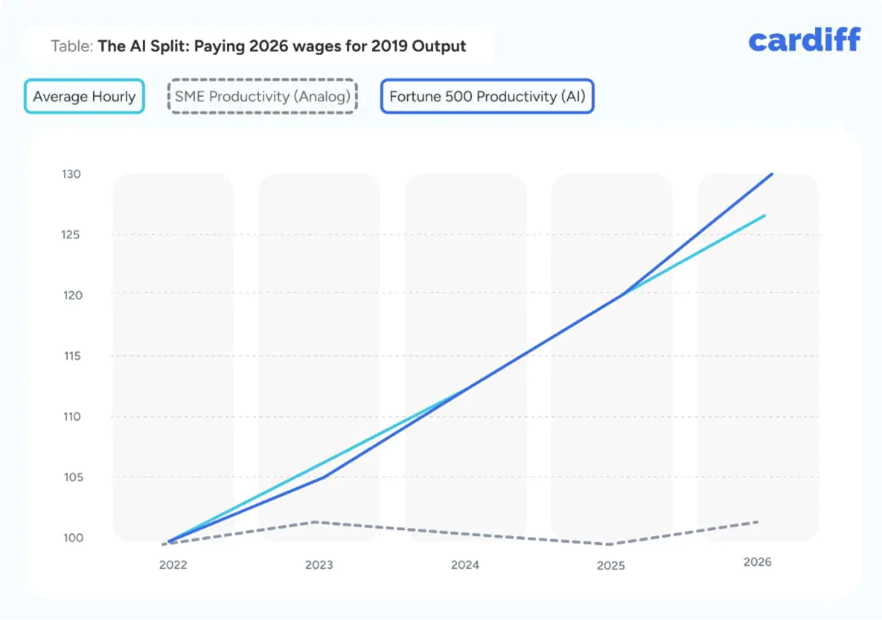

The report also addresses the “K-Shaped” nature of recent labor productivity gains. While Q3 2025 posted a 4.9% surge in productivity, these gains are largely realized by Large Cap Tech firms through AI. Service-based small businesses are seeing the wage inflation associated with the boom without the efficiency gains. “Main Street is paying ‘AI Wages’ for ‘Analog Productivity,'” Stern notes. “You cannot pay 2026 wages with a 2019 operational model.”

Strategic Recommendations

Cardiff recommends an immediate shift to “Cash Conversion Cycle” management. “The businesses that survive 2026 will be the ones that accept the new math and protect their cash flow,” Stern concludes. Recommendations include protecting liquidity, passing the “Shadow Tax” to consumers immediately, and automating to bridge the productivity gap.

About Cardiff

Since its founding in 2004, Cardiff has funded over $13 billion to small businesses, establishing itself as a leader in the industry. This leadership is underscored by its recent honor from Working-Capital.com, which named Cardiff “America’s Favorite Small Business Lender” for the second consecutive year (2024 & 2025).

This recognition is supported by a Net Promoter Score (NPS) of +82—a score typically associated with elite consumer brands—and a proven ability to deliver on its promise of “approval in minutes and funding same day.” Analysis confirmed Cardiff’s automated underwriting engine provides decisions in under five minutes, with a median time from application-to-cash of under eight hours. Having been featured in leading financial outlets such as Forbes, Standard & Poor’s, Barron’s, and American Banker, Cardiff continues its mission to provide the capital and resources that American entrepreneurs need to thrive.

For commentary and media inquiries please contact alison@cardiff.co.

Follow us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Other