Let’s be blunt: the global financial system has a colossal crime problem. Every year, criminals wash up to $2 trillion, which is like erasing 5% of the world’s entire economic output. They’re funding everything awful, from terror networks to trafficking rings. For too long, the people meant to stop them. Banks, fintechs, regulators have been fighting with one hand tied behind their backs, stuck in their own corners.

That’s finally starting to change. The old way of doing things is hitting a wall. The only path forward is a united one, where everyone starts using the same playbook to outsmart a common, and very clever, enemy.

How the Scams Actually Work

Most of the dirty money flooding the system doesn’t just appear; it’s stolen from ordinary people through increasingly crafty scams. Understanding these cons is step one.

The biggest monster in the room is Authorized Push Payment (APP) fraud. This is where a con artist tricks you into sending them money yourself. It’s shockingly effective. In the UK, it accounted for a breathtaking £459.7 million in losses just last year. Often, it starts with an impersonation scam, that urgent text message pretending to be your bank or a panicked call from someone claiming to be from a government agency.

Then you have the slow-burn schemes. Investment and romance scams, particularly the nasty variant known as “pig butchering”. That’s a masterclass in psychological manipulation. Fraudsters spend months building trust, pretending to be a friend or romantic partner. They groom their target, coaxing them into fake crypto investments, and then vanish when the pot is big enough. It’s a huge driver behind the $4.57 billion in investment fraud the FBI tracked in 2023.

None of this would work without the plumbing. Mule accounts are the critical pipes that move the stolen cash around, making it hard to trace. And to open these accounts, criminals often rely on fake personas that are just real enough to fool the automated KYC checks that banks use.

The Grind of Modern AML

If you work in compliance, you know the daily struggle. The systems meant to flag crime are often just creating noise. It’s a deluge of alerts, and the vast majority are false positives, burying analysts in make-work while the real threats slip through the cracks.

The core frustrations are universal:

- Siloed Views: Your institution sees a tiny piece of the criminal puzzle. Another firm sees a different piece. Nobody talks, so nobody ever sees the whole picture of how a laundering network operates.

- The Speed Problem: Criminals move money across borders in the blink of an eye. With instant payment systems, that money is often gone for good before anyone even realizes a crime has occurred.

- Constant Change: The moment you figure out one criminal method, they’ve already moved on to three new ones. Static rulebooks become obsolete almost as soon as they’re written.

- The Reporting Mountain: The regulatory load is immense. Just look at FinCEN, which was buried under more than 3.6 million Suspicious Activity Reports (SARs) in a single year.

A New Playbook: Fighting Smart, Together

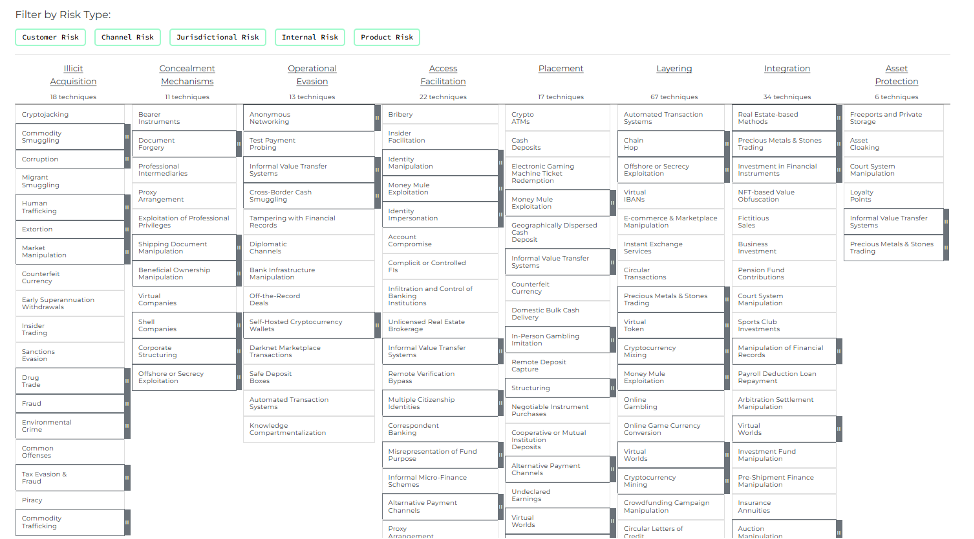

The world of cybersecurity figured this out years ago with MITRE ATT&CK: you can’t win a network fight on your own. Now, financial crime fighters are borrowing that playbook with AMLTRIX. The goal is to build a shared, open-source “periodic table” for financial crime. A common language that everyone can use to describe the same threat in the same way.

When everyone agrees on what a specific type of layering or mule activity looks like, the game changes. It moves the entire industry from a reactive, isolated posture to one of proactive, collective intelligence.

The real power move here is making this knowledge readable by machines. When criminal techniques are mapped out in a structured way like in AMLTRIX’s framework, you can train AI to hunt for them. These aren’t your grandpa’s clunky, rule-based alerts; this is about teaching algorithms to spot the faint signals of new and emerging criminal patterns before they become a full-blown crisis.

Real-World Defenses That Actually Work

This isn’t just theory. A modern defense system looks beyond just the transaction. It’s about context, behavior, and networks.

You get there with smarter tools and data:

- Velocity Checks: How fast is money moving in and out? Is it behaving like a normal customer’s account or a criminal’s revolving door?

- Behavioral Clues: It’s not just what a user does, but how. Are they logging in from a strange place? Is their typing speed different? These digital fingerprints can be a dead giveaway for fraud.

- Knowing the Neighbors: It’s no longer enough to vet your own customer. You have to analyze the risk of who they’re sending money to and receiving it from.

When you have these richer signals, you can finally triage the mountain of alerts and point your human experts toward the cases that truly matter. That means the SARs you file are no longer just a compliance checkbox; they’re genuinely useful intelligence for law enforcement.

The Balancing Act

Of course, none of this is simple. If you crank up the security controls too high, you start blocking legitimate payments and infuriating good customers. There’s a constant tension between catching criminals and providing a smooth experience.

And then there’s privacy. Using data to sniff out crime is essential, but it has to be done ethically and within the bounds of laws like GDPR. The ultimate aim is to build a system that is both smarter and more responsible, one that protects people’s money and their data with equal vigor.